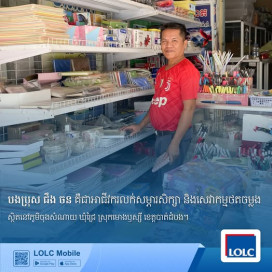

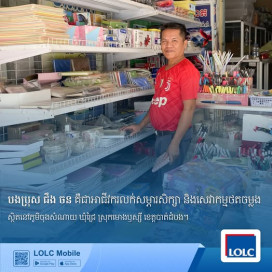

Mrs. Thoeun Tha is the owner of a small restaurant, and her husband, Mr. Pou Khat Chea, works as a soil-transport truck driver. They live in Kancham Village, Kancham Commune, Pea Reang District, Prey Veng Province. They have three children, two daughters and one son. Currently, their eldest daughter is studying at university, while their son and youngest daughter are in high school.

Though she’s busy preparing food, Mrs. Tha happily and warmly shared some of her experiences regarding the growth of her business. She explained that being able to cook delicious food alone is not enough to attract customers; it must be combined with proper hygiene, good food presentation, and an organized, appealing shop layout.

Mrs. Tha added that behind the success of her restaurant is the support she received through loans from LOLC Cambodia, which she used as capital to improve and organize her shop. She has taken two loan cycles to expand her business, her first loan of USD 2,000 in 2021 and her second loan of USD 4,000 in 2023, both used to beautify and upgrade her restaurant for more comfort and convenience.

Using the loans to expand the business has helped her not only retain her existing customers but also attract many new ones, resulting in a steady increase in her income. Thanks to this growth, Mrs. Tha is now able to fully support her children’s education, helping them pursue higher studies as she always hoped, while also ensuring a happier and more prosperous life for her family.