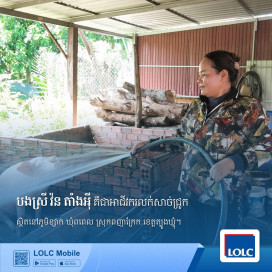

Capital is truly essential for Mrs. Vorn Tang E!

While washing her pigs, Mrs. Tang E gave an interview to LOLC staff with a bright smile, saying “I am fully able to establish a pig-raising business for resale and pork sales thanks to the support from LOLC Cambodia loans.” With this support, she gained enough capital to establish and expand her business, which has continued to grow and thrive to the present day.

Mrs. Tang E explained that in the beginning, she was only a farmer. Later, with financial backing from LOLC Cambodia, she started a new business of buying and selling pigs, located in Khsak Village, Khsak Commune, Popeal District, Tbong Khmum Province. Without hesitation, she further shared that she has used LOLC Cambodia loans for four different cycles, starting with the first one to create her pigs reselling business and then subsequent loans to expand the business to its current success.

In her concluding remarks, she expressed satisfaction with LOLC Cambodia’s loans, as they provided her with the opportunity to establish a new business and helped her grow it successfully. This has also improved her family’s economy and living conditions, thanks to the significant increase in income.