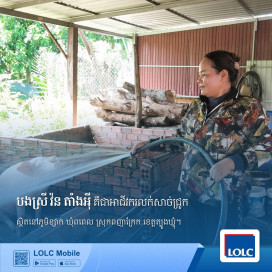

Mrs. Pes Phalla’s achievements stand as a testament to the power of responsible financial planning. As a successful client of LOLC Cambodia, she has demonstrated exceptional progress through the purposeful and effective use of her loans. Residing in Ou Mkak Village, Dambouk Khpos Commune, Angkor Chey District, Kampot Province, she runs a grocery business while her husband, Mr. Nen Boeun, operates a motorcycle repair shop.

Mrs. Phalla shared that she was previously employed at a casino, and her husband had no stable employment. After receiving advice from her mother-in-law, a long-time client of LOLC Cambodia, she became interested in the financial services offered and decided to apply for her first loan in 2018. This initial loan enabled her to purchase essential motorcycle repair equipment, allowing her husband to establish his own business. Over time, Mrs. Phalla took out two additional loans, which she used to expand her grocery business and renovate their home, making it more comfortable and livable.

As a result of using the loans wisely and with a clear purpose, Mrs. Phalla’s family has experienced substantial financial growth. She is pleased to report that the increased income has enabled them to buy a car, a motorbike, and other necessary household items, while also transforming their home into a more comfortable and well-maintained environment.